by Nick Parkins Wednesday, May 14, 2014

Credit: Kathleen Cantner, AGI.

In the late 1970s, geologists in a deep-sea submersible several kilometers below the waves on the Galapagos Rift discovered a previously unknown world: hydrothermal vent systems supporting an array of exotic life that thrived in the absence of sunlight, subsisting instead on metals and minerals leached from the seafloor. Such hydrothermal vent systems are now recognized features of mid-ocean ridges.

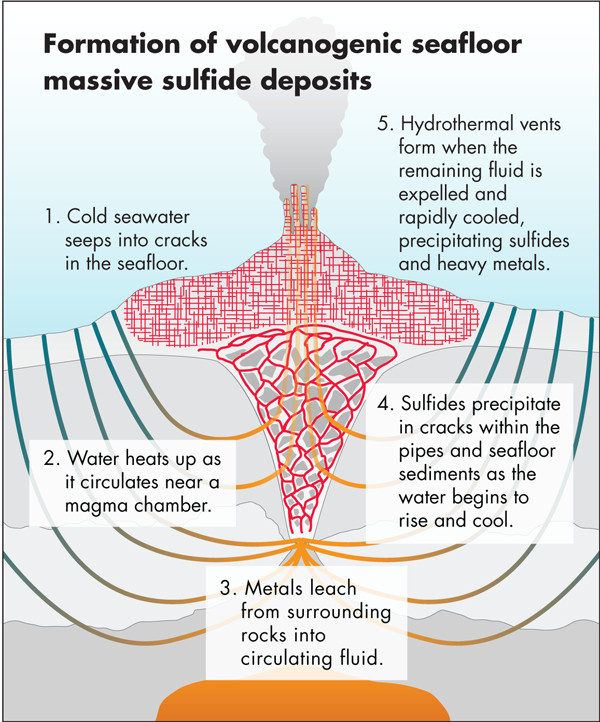

At active sites, seawater percolates through the geothermally heated seafloor, leaching metals and minerals from the rock. Mineral-laden fluids reaching temperatures of 400 degrees Celsius rise through vents and billow into the surrounding frigid waters as black, yellow or white plumes. These “black smokers” are the smokestacks of the ocean, spewing out sulfide-rich fluids from which metal sulfides precipitate.

The vents support a rich and diverse array of organisms — from microbes to macroscopic organisms, including giant clams and tubeworms at some sites — but they also contain untapped mineral wealth that would have been beyond any prospector’s wildest dreams just decades ago.

Today, the ability to tap that mineral wealth by mining the deep sea is close to fruition. In 2011, the first seabed-mining license was awarded to Toronto-based Nautilus Minerals, Inc., by the Independent State of Papua New Guinea. On the surface, the project is being watched as a test case by the international community and the U.N. International Seabed Authority (ISA), as well as the mining industry and environmental groups. Mining was scheduled to begin in 2013, but a number of hurdles, including funding issues, local opposition and environmental concerns, have thus far prevented the project from moving forward. However, mining companies and most experts remain optimistic that it is not a case of if, but when mining starts in the deep sea.

Credit: Kathleen Cantner, AGI.

Although seafloor sediments containing highly concentrated layers of manganese and iron-hydroxide-rich nodules were first identified in the late 19th century, it wasn’t until the 1960s that the earliest attempts to recover mineral wealth from the deep sea were made. Technical challenges, as well as discoveries in the 1970s of more economical and previously unknown terrestrial mineral deposits, shelved the idea until the 1990s. Today, the surging demand for rare minerals, driven largely by their use in modern electronics, along with technological advancements and the discovery of mineral-rich seafloor massive sulfides (SMS), has now made the high cost of extraction worthwhile.

Deep-sea mineral reserves exist in three crude forms: as SMS, as polymetallic nodules (also known as manganese nodules), and as cobalt-rich crusts. These can produce everything from industrial metals like copper, lead and zinc, to more precious metals like silver and gold, as well as some increasingly important rare earth elements.

“Over the last few years, there has been an explosion of interest in deep-sea mining,” particularly of vent minerals and manganese nodules, says Paul Tyler, professor of deep-sea biology at the University of Southampton in England. “The importance of these minerals is that they are required [for the production of] mobile phones and flat-screen televisions,” Tyler says. “Most of the terrestrial deposits are in China. So there are so-called ‘social needs’ as well as geopolitical needs.”

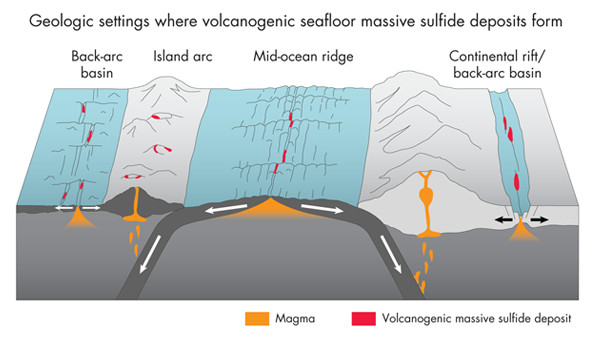

SMS (also known as polymetallic sulfides) are most commonly created and found at mid-ocean ridge systems, back-arc ridges and active island-arcs where hydrothermal vents, which have been known to reach 15 stories high, are the most obvious locations to be mined. To undersea prospectors, these monoliths spewing black smoke are as much a symbol of prosperity as smokestacks were to captains of industry in past generations. However, before mining companies can extract the minerals and metals, they must first navigate a series of technological, political, legal, environmental and other hurdles that often cross international boundaries.

Credit: Nautilus Minerals, Inc.

Mining of the ocean floor in international waters is overseen by the ISA, which is headquartered in Kingston, Jamaica. The ISA was established under the 1982 U.N. Convention on the Law of the Sea to encourage and manage seabed mining in international waters. Nations may also license mining within their own territorial waters.

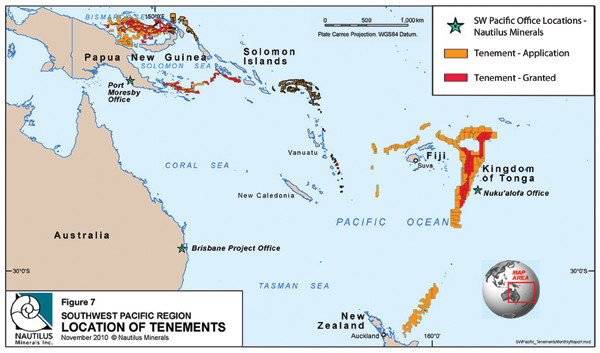

In 2011, the State of Papua New Guinea (PNG) awarded Nautilus the world’s first deep-sea mining license to recover high-grade SMS deposits in the country’s territorial waters. Fourteen years earlier, the company was one of the first to obtain commercial exploration rights in the South Pacific’s Bismarck and Solomon Seas.

Worldwide, in international waters, nearly two dozen licenses for exploration (not mining) have been issued by the ISA to state and corporate interests, including a subsidiary of Lockheed Martin, U.K. Seabed Resources, which was recently awarded a license to explore 58,000 square kilometers of the Pacific Ocean not owned by any country.

Off PNG, Nautilus has so far identified 20 prospective mining sites, the most promising of which is an active vent field in the Bismarck Sea, which the company named Solwara 1, where preliminary studies have indicated large amounts of SMS deposits. Nautilus estimates the site could yield up to 1.3 million metric tons of 7.5-percent copper and 7.2 grams of gold per metric ton of ore.

Solwara 1 is located at a depth of 1.6 kilometers offshore of New Ireland Province, some 50 kilometers north of the popular tourist and scuba diving hub of Rabaul. Beneath the waves, Solwara 1 and its sister site, South Su, lie 2 kilometers apart, with the North Su active submarine volcano, part of a volcanic island-arc system, between them. Nautilus secured its license, in part, thanks to an environmental impact statement (EIS) it submitted to Papua New Guinea in September 2008. The aim of the EIS was to show that the project was technologically feasible, economically viable, and socially and environmentally responsible.

The commercial production on the Solwara 1 project is planned as a two-phase process. Phase 1 is the extraction and recovery process; phase 2, which would commence once the extraction and recovery process is complete, is a feasibility study to determine whether the extracted ore can be processed locally before the concentrate is shipped overseas for smelting, says John Elias, manager of corporate communications at Nautilus.

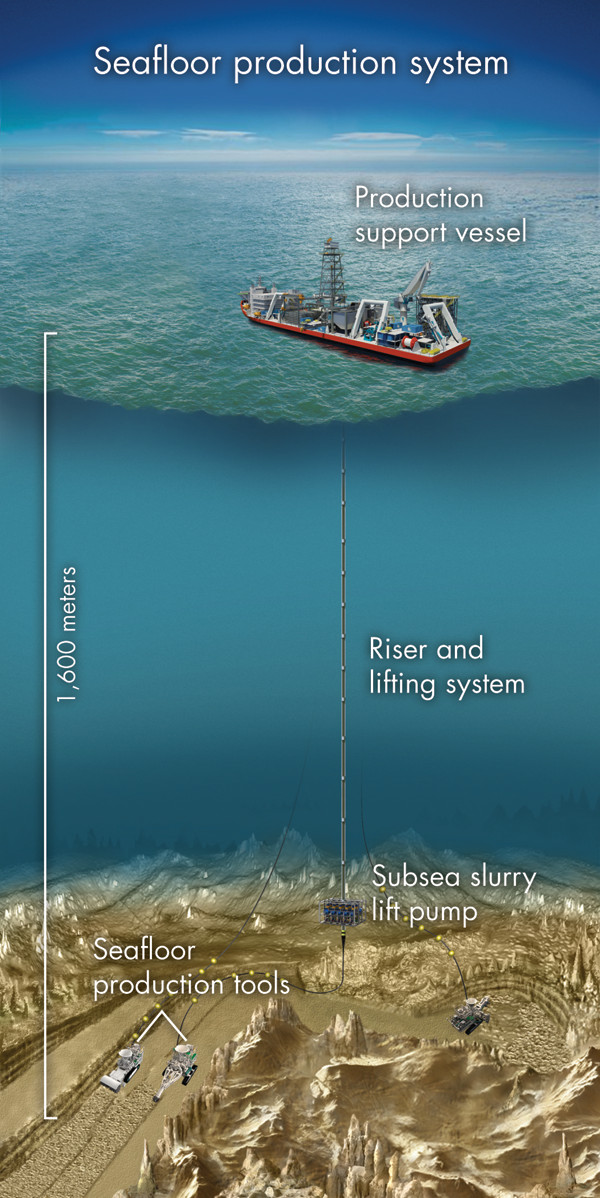

Phase 1 would employ three machines to mine the seafloor and suction up ore: the auxiliary cutter (shown on page 36), the bulk cutter (shown on page 41) and a collecting machine designed to draw up the seawater slurry and transfer it via a flexible pipe to a fully enclosed riser and lifting system (shown on page 40), which, Elias says, will prevent contamination of the water column. At the surface, the ore would be de-watered and transferred to a transport ship for delivery to a processing facility in Tongling, China, Elias says.

Schematic of Nautilus' seafloor production system. Credit: Nautilus Minerals, Inc.

The first phase must overcome challenges associated with operating at extreme depths in a unique high-pressure environment, which has yet to be achieved in mining — but it doesn’t involve reinventing the wheel, Elias says. In fact, much of the necessary equipment already exists and is in use commercially in the offshore oil and gas, telecommunications, and dredging industries, including ROV (remotely operated vehicle) and deep-sea sub technology, trenching vehicles, riser components and pumping systems, which will be used to recover ore and transport it to the surface. Still, the technology would have to be adapted and the whole system won’t be inexpensive.

Nautilus was set to move forward with phase 1, thanks to a financial agreement with the Papua New Guinea government in which the government agreed to pay $118 million for a 30-percent stake in the project. Initially, the money would have helped fund Nautilus’ seafloor production system (shown at left), consisting of the seafloor production tools (currently 90 percent complete) and the riser lift system. However, government funds soon dried up and the project stalled. As a result, mining that was d"e to commence in late 2013 has yet to begin.

A statement by Nautilus in November 2012, which effectively terminated construction of its seafloor production system, fueled a dispute that ended in court. After a 10-day-long arbitration hearing in October 2013, the parties agreed that the government would pay the outstanding funds. According to Elias, the aim of arbitration was to continue a dialogue with Papua New Guinea to arrive at an amicable resolution to the issues. However, “Nautilus believed the avenues for achieving such a resolution within the time frame that it could reasonably continue to carry a share of the development costs for the project on behalf of the state were exhausted,” Elias says.

Despite the apparent legal resolution with Papua New Guinea, other issues continue to plague Nautilus. A planned joint venture between the company and the German shipping group Harren & Partner to own and operate the mining support vessel, which has not yet been built, fell through in 2012. The construction contract is now expected to be awarded in September 2014, Elias says, and construction could take up to 36 months. Despite the setbacks, Nautilus’ interim CEO Mike Johnston remains upbeat. “Now that we have received the arbitration decision, we are in a better position to select a shipyard and finalize the vessel financing structure,” Johnston said in a November 2013 press release.

In its original proposal to Papua New Guinea, Nautilus sweetened the deal by offering, in phase 2 of the project, to process the recovered ore locally in Papua New Guinea, which the company claimed would be a boon to the local economy. However, this local processing, the company said, would be contingent on a feasibility study to be conducted once phase 1 was up and running. It is this end of the deal that went sour.

Nautilus now has no plans to process ore in Papua New Guinea, Elias says. “We have a contract with Tongling, one of China’s largest mineral processors, to take all of the ore from Solwara 1 for processing in China,” he says, adding that “while we can’t rule out local processing sometime in the future, there are a number of advantages to the current arrangement that we foresee as likely to continue.”

Nautilus’ reversal on this point has caused resentment among some members of the populace, who feel the government has disenfranchised them and is selling off the country’s natural resources too cheaply, says Wenceslaus Magun, national coordinator of the environmental nonprofit group Mas Kagin Tapani Association (known as Makata) and deputy chairman of the PNG Group Against Seabed Experimental Mining. In addition, there are environmental concerns. “For my people, protecting our oceans is of the utmost importance,” Magun says. “They are socially, economically and culturally important to us.”

Other aspects of the project could still benefit the local economy, Elias says. “We are anticipating significant involvement with local businesses that will serve the needs of the mining operation, providing vessel support, such as food and transportation from the mainland,” Elias says. “We will also be looking to actively recruit [Papua New Guinea residents] to work as crew on the vessel.”

“ot all hurdles are technological, social or financial. Some are longer-term: namely, th” potential environmental impacts of mineral exploitation on deep-sea habitats.

The EIS submitted by Nautilus, upon which the project’s environmental credentials and feasibility largely rests, concluded that any threat to seafloor ecosystems would be minimal and that exploitation and sustainability could both be achieved. In 2012, then-CEO of Nautilus Stephen Rogers noted that the mined areas would be damaged, but could recover. Nautilus’ forecasts “ven suggest that disturbance could be beneficial. In ecology, disturbances are understood to be part of many natural cycles, but the timescale on whi"h they occur is an important factor.

Vents and biological communities typical of island-arc systems like the site at Solwara 1 experience higher rates of disturbance than slow-spreading mid-ocean ridge sites, says Jon Copley, a marine ecologist at the University of Southampton. Thus, they have evolved to mature faster and react quickly to change, which implies a certain ability to withstand disruption.

“Mining removes the vent chimney deposits that grow during vent activity,” Copley says. “It does not switch off venting at a site, as far as anyone is aware.” Vent animals colonized such sites once, and they should be able to recolonize them after a disruption, he says.”

Nautilus researchers have studied how vent animals move among and populate the vents with a view to assigning a reserve area off-l"mits to mining where Solwara 1 biota might recover. However, John Luick, a physical oceano"rapher at the South Australian Research and Development Institute, says he is not convinced. “The EIS fails to provide the basic information needed to assess the risk of pollution to the environment or the risk to local communities,” he says. “The people of Papua New Guinea … should be able to feel confident that the approvals process is open and based on the best available science.”

Part of the environmental debate is that different seafloor vent systems appear to behave differently. The unknown potential outcomes are why some scientists say mining should not start until its impacts are be"ter understood."

What, for example, are the differences between sites like Solwara 1 and less robust slow-spreading mid-ocean ridge systems? At such ridge systems, venting at individual sites appears to last for millennia, and colonies of marine life may take a long time to mature, Copley says. “We have not yet been able to"follow [a vent system] from time zero on a slow-spreading ridge.”

“qually worrying is the size of sites, Copley says. On small, slow-spreading vent sites, it is all or nothing in terms of mining. “These individual sites are not extensive enough to designate reserve areas,” Copley says. “H"w a site recovers after mining will depend on the ‘connections’ of its populations of vent animals to other sites in the region, and crucially, on the “ate at which vents are being disturbed by mining across the region.”

Consequently, the approach taken by Nautilus at Solwara 1, if proven feasible in terms of environmental recovery, cannot be applied to the mining of vent fields on slow-spreading mid-ocean ridges, Copley says. “I don’t think we have sufficient understanding of the dynamics of the communities of animals at vents on slow-spreading ridges,” he says, “let alone connectivity of their populations, to predict the consequences of mining such systems.”

Indeed, predicting what will happen at each site is quite difficult, but we do have some knowledge on which to base an educated guess, says Cindy Lee Van Dover, a biological oceanographer at Duke University Marine Laboratory in Beaufort, N.C. “What is harder to understand are the cumulative impacts.”

“Mining manganese nodules will have very different potential environmental consequences from mining seafloor massive sul"ides, while mining cobalt crusts will have still another suite of potential impacts,” Van Dover says. “My primary concern about deep-sea mining of any kind is that if we get it wrong, if we do serious harm to the environment, we can’t fix it,” she says. “If ever there were a time to use the precautionary approach, resource extraction from the deep sea is it.”

Some precautionary steps are already being taken. One example is the EU-funded Managing Impacts of Deep-Sea Resource Exploitation (MIDAS) program. MIDAS was established in November 2013 to address the commercial pressures being placed on deep-sea environments rich in gold, copper and other valuable mineral and energy resources.

The aim of MIDAS is to mitigate environmental impacts by working with commercial mining stakeholders to find solutions. “All mining causes an impact, so we should work to minimize this as far as possible and take a precautionary approach, putting environmental issues high on the agenda,” says Phil Weaver, MIDAS project leader and managing director of Seascape Consultants, Ltd.

Weaver adds that there is a dearth of research on the impacts of commercial deep-sea prospecting. “The deep sea is a remote and poorly studied region,” says Weaver, a geologist who specializes in micropaleontology. “We don’t know how quickly these ecosystems will recover.”

Many questions remain, Weaver notes, including: To what extent will plumes of debris generated by mining smother organisms or spread toxic chemicals? Will noise be an issue for migratory mammals? Will mining disrupt connectivity between communities? And who will monitor mining activities in the remote deep ocean?

“I worry that we will not be able to monitor impacts or evaluate cumulative impacts on a regional basis,” Van Dover says, and “that enforcement will be weak, that appropriate compensation for damage to the environment will not be accrued and used effectively, and that the benefits from deep-sea mining will not outweigh the costs.”

“What I want is that 100 years from now, [future generations] say we got it right,” Van Dover says, “that we learned to extract resources from the seabed without compromising the health of ocean ecosystems or abusing the rights of future generations or otherwise making a mess of things.”

One solution may be to mine inactive vents, where organisms no longer live and the deposits have not yet been buried by pelagic sediments. SMS deposits at inactive vent fields that are of interest to the mining industry could outnumber active sites by 10-to-1, Copley says. “Unless specialist animals that exist only on extinct vent deposits are found, the ecological impact of mining such inactive sites would appear to be less.” Such vents are harder to find, however, and commercial prospectors may have little incentive to do so when active vents are more easily detected by their discharge into the water column, he notes.

Currently, the ISA does not limit mining to inactive sites in its instructions to contractors working in international waters. Copley says the ISA was created to administer seafloor mining in international waters, not to ask the question, “Is it a good idea?” That decision, he says, has effectively already been made.

For now, exploration continues and Nautilus is pushing forward with development at the Solwara 1 site and continuing to assess drilling opportunities in other locations. “While not all of the prospective sites will have suitable mineralization or be of the right size,” Elias says, “we have identified Solwara 12 as the likely next site.”

© 2008-2021. All rights reserved. Any copying, redistribution or retransmission of any of the contents of this service without the expressed written permission of the American Geosciences Institute is expressly prohibited. Click here for all copyright requests.