by Yael R. Glazer, Jamie J. Lee, F. Todd Davidson and Michael E. Webber Thursday, April 6, 2017

Water produced from oil and gas development in shale formations could provide lithium needed for batteries. Credit: Chris Boyer, Kestrel Aerial Services, Inc., CC BY-ND 2.0.

By Yael R. Glazer, Jamie J. Lee, F. Todd Davidson and Michael E. Webber

Petroleum-based fuels like gasoline and diesel have dominated the transportation sector for the last century — and they still do. However, policymakers and technocrats are looking toward electric vehicles (EV) to move away from gasoline and diesel. With the support of favorable policies and consumer preferences, EVs, led by Tesla’s lineup, are taking off. Already, more than a half million EVs are on the roads in the U.S. and more than a million are on roads worldwide. Dropping internal combustion engines in favor of EVs would seemingly be at odds with the idea of increasing domestic oil and gas production, but the trends come together synergistically in ways that are surprising.

In the last decade, major technological advances in hydraulic fracturing and horizontal drilling have tapped into formerly inaccessible shale deposits around the United States, yielding billions of barrels of oil and trillions of cubic feet of natural gas. Production during this shale revolution has reduced the cost of oil-derived products and natural gas while simultaneously mitigating domestic energy security concerns regarding imported oil and reducing emissions — three major policy priorities set forth over the past few decades.

In that same time, as a result of the shale boom, the U.S. has seen domestic crude oil production increase by approximately 86 percent. Consequently, U.S. net imports (imports minus exports) were lower in 2015 than they have been since 1970. Additionally, because natural gas has half the carbon content as coal on a per-unit-energy basis, the abundance of affordable gas has displaced the utility of many coal-fired power plants, leading to the lowest emissions from the power sector nationwide in decades. Because of the shift from coal to natural gas for electricity generation, the transportation sector’s tailpipes are now a larger cumulative emitter of carbon than the electric grid’s smokestacks.

Tesla is leading the pack for electric vehicles, but will need a lot of lithium for its batteries. Credit: Alexis Georgeson, Tesla.

This new status as the most carbon-intensive part of society has put the transportation sector in the target of stakeholders seeking to clean up their act. EVs remain one of the favored pathways for achieving that goal. And the shale revolution could, in fact, prove to be a critical and helpful partner for EVs in two ways: First, EVs have to be charged with electricity produced by some means, and many do so with power from natural gas-fired power plants. Second, it turns out that the wastewater from shale production in certain regions of the U.S. has relatively high concentrations of lithium, which could be recovered and used to make the lithium-ion batteries necessary for EVs.

Lithium is a naturally occurring element facing growing demand due to its usage in lithium-ion batteries — the type of batteries generally used in EVs, in portable electronic devices like smartphones and tablets, and for bulk grid storage. In fact, very recently, the price of lithium has soared as a result of growth and the anticipated increased demand of products that depend on lithium-ion batteries. The price per metric ton of lithium carbonate imported to China (where many lithium-ion batteries are made) saw an increase of approximately 50 percent from 2009 to 2015; then it more than doubled within just two months in 2015. If demand continues to increase, it is likely that the price of lithium could follow suit in other areas of the world unless additional supplies are brought to market.

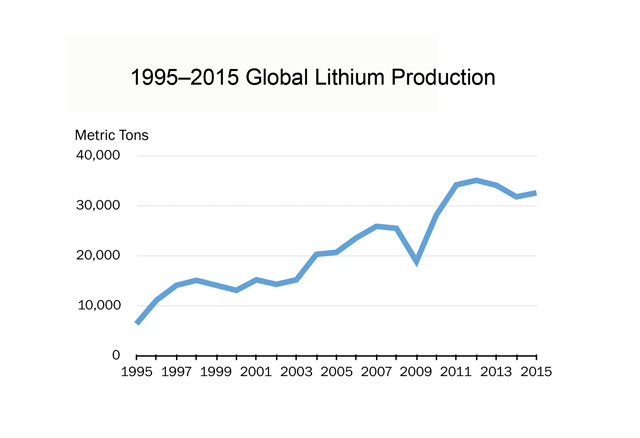

Lithium production has increased in recent years. Credit: Jeffrey Phillips, data from: minerals.usgs.gov/minerals/pubs/commodity/lithium/.

Much was written last year about a looming lithium shortage, but there doesn’t seem to be a shortage in lithium supply worldwide. In 2015, lithium demand was approximately 32,500 metric tons, a tiny fraction of global lithium reserves — the amount considered currently economically recoverable — which the U.S. Geological Survey (USGS) estimates to be about 14 million metric tons.

According to USGS, Chile holds the world’s largest reserves with 7.5 million metric tons, followed by China, Argentina and Australia. Identified lithium resources — a measure that includes both proven reserves and stocks inferred to exist — total about 40 million metric tons. Bolivia holds the most with almost 23 percent of the world’s lithium supply (more than 9 million metric tons); Chile also holds a significant portion. The U.S. holds 38,000 metric tons of lithium reserves and 6.7 million metric tons of lithium resources.

However, the global lithium production market is fairly consolidated, with only four companies currently producing the majority: SQM in Chile; FMC in the United States; Tiangi in China; and the world’s largest producer, Albemarle, another American company. These companies produce lithium mostly from Chile, Argentina, Nevada and Western Australia.

It appears that there is enough lithium produced to supply current demand. But things get sticky when we start looking at future demand.

Lithium is needed for the ever-growing production of lithium-ion batteries for everything from smartphones and laptop computers to electric car batteries. Credit: Kristoferb, CC BY-SA 3.0.

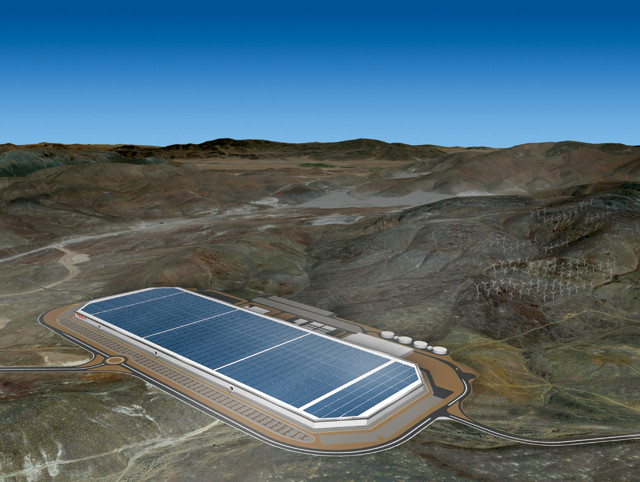

One of the most headline-grabbing developments related to EVs and battery production is Tesla’s Gigafactory, for which the company broke ground in 2014. This behemoth facility located outside of Sparks, Nev., is expected to produce 35 gigawatt-hours (GWh) per year of lithium-based batteries by 2018, mostly for the company’s EVs. Output is expected to eventually reach 150 GWh annually. To put this into context, by the end of this decade, Tesla hopes to produce enough battery packs to power their expected production of 500,000 EVs a year. Keep in mind that it took roughly a decade to get 500,000 electric cars — from all makers, not just Tesla — onto U.S. roads in the first place.

Based on our estimates, the lithium-ion batteries that the Gigafactory plans to manufacture will require approximately 4,000 metric tons of lithium annually while the factory’s capacity is at 35 GWh. When the factory reaches the intended full capacity, the lithium requirements might quadruple to more than 16,000 metric tons, which is about half the total amount of lithium consumed worldwide in 2015.

Tesla’s vision is bold and will require a secure and steady supply of many resources, including lithium, to streamline operations and reduce the price for lithium-ion batteries. Domestic sources of lithium — including lithium extracted as a byproduct of hydraulic fracturing — might help ensure the secure and steady supply that is needed.

The Tesla Gigafactory near Sparks, Nev. (shown here in January 2017), is expected to produce 35 gigawatt-hours per year of lithium-based batteries by 2018, mostly for the company's electric vehicles. Credit: Alexis Georgeson, Tesla.

By geologic fortune, some of the country’s major shale oil- and gas-producing resources naturally contain significant amounts of lithium, some of which comes to the surface in produced water along with mined oil and gas.

Produced water generated from shale oil and gas operations contains numerous constituents, including lithium, the concentrations of which all vary by region depending on geology. Some, like naturally occurring radioactive materials, present clear environmental and health hazards. High salt and total dissolved solids (TDS) concentrations in produced water are also hazardous. TDS levels in produced water can be upwards of 250,000 milligrams per liter in places like the Bakken in North Dakota — nearly an order of magnitude more saline than seawater at about 35,000 milligrams per liter. These elevated concentrations present environmental hazards in the event of spills.

Artist's conception of the Tesla Gigafactory. Credit: Alexis Georgeson, Tesla.

Because of the often hazardous composition of produced water, the predominant management strategy in most regions is to sequester it underground via deep well injection. However, because deep well injection has been linked to earthquakes in areas not traditionally considered seismically active — such as Oklahoma and Ohio — and because other shale-producing regions, like Pennsylvania, have few permitted injection sites, identifying new management methods for wastewater from shale oil and gas production is critical.

There are other options for the handling of wastewater from oil and gas extraction, some with potential benefits. For example, local communities could use the salty, produced water to de-ice roads. Cleaned-up wastewater could potentially be used for irrigation, or even discharged to surface waters where permitted by regulation. The mineral-rich water could also potentially be a source of lithium.

Charging a Tesla. Credit: Alexis Georgeson, Tesla.

Just how much lithium is contained in produced water is hard to know, given that oil and gas operators are rarely required to report water-quality data about their wastewater. USGS does make some information public, however. From this limited dataset, along with data from our own research with various oil and gas partners, we estimate lithium concentrations in produced water from across the Marcellus Shale region — stretching across much of Appalachia and into the Northeast — of approximately 80 to 200 milligrams per liter.

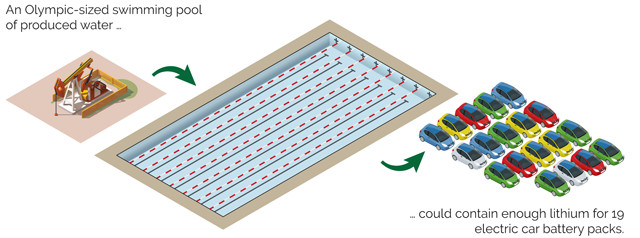

In 2014, the volume of produced water in Pennsylvania (presumably mostly from the Marcellus Shale but also from the Utica Shale) alone was approximately 29 million barrels, or 1.2 billion gallons. If we consider 120 milligrams of lithium per liter as a typical concentration for the region, we calculate that Pennsylvania’s wastewater contained about 545 metric tons of lithium.

Wastewater from oil and gas production is drained into pits, like this one in Wyoming. Credit: Yael Glazer.

It’s highly unlikely that all the lithium in produced water could be economically recovered. But even with a 60 percent recovery rate — an estimate based on published research detailing methods and recovery rates for lithium extraction from brine waters — the produced water from Pennsylvania alone could potentially supply approximately 8 percent of Tesla’s annual lithium needs once it reaches full-scale production — not a trivial amount. This percentage could increase if produced water in other oil- and gas-producing shale regions in the U.S. also contains lithium.

The remaining question is how feasible — both technically and economically — it is to extract lithium from the produced water of oil and gas operations. Based on available published research, we are confident that it is technically feasible. However, it is unknown how expensive it would be to extract lithium from produced water from oil and gas wells.

A natural gas drilling site in the Haynesville Shale in Louisiana. Credit: Daniel Foster, CC BY 2.0.

Currently, lithium is often extracted from underground brine pools, which have immense volumes, unlike the relatively small water volumes of oil and gas wells. The economies of scale for traditional lithium harvesting bring the extraction cost down and makes the process economically viable. Due to the distributed nature of supplies of produced water — coming from numerous oil and gas wells not always owned by the same operator and spread over large areas — it remains to be seen if using existing extraction methods is economically feasible at current lithium prices. As oil and gas producers move toward wastewater treatment and reuse to avoid expensive disposal costs, it will be interesting to see if it becomes possible to extract the lithium for minimal additional cost.

Olympic swimming pool Credit: Jeffrey Phillips.

If lithium prices continue to increase, though, it might not be long before separating lithium from produced waters becomes attractive even without other developments. If that happens, shale production would not only be a source of natural gas to produce electricity with which to charge batteries, but could become a domestic source of critical minerals for manufacturing batteries for electric vehicles.

© 2008-2021. All rights reserved. Any copying, redistribution or retransmission of any of the contents of this service without the expressed written permission of the American Geosciences Institute is expressly prohibited. Click here for all copyright requests.