by Mary Caperton Morton Wednesday, February 13, 2019

More than 114,000 residential and commercial structures in and around the Los Angeles area were damaged during the 1994 Northridge earthquake. At the time, roughly 25 percent of homes in California were covered by earthquake insurance. Today, only about 10 percent of homes in the state are covered. Credit: Federal Emergency Management Agency.

Many parts of California are at risk for large, damaging earthquakes. Yet only about one in 10 homes in the state is covered by earthquake insurance. Now, a new insurance option offers a means to supplement traditional insurance plans and provides a way for uninsured Californians to obtain at least a modicum of earthquake coverage.

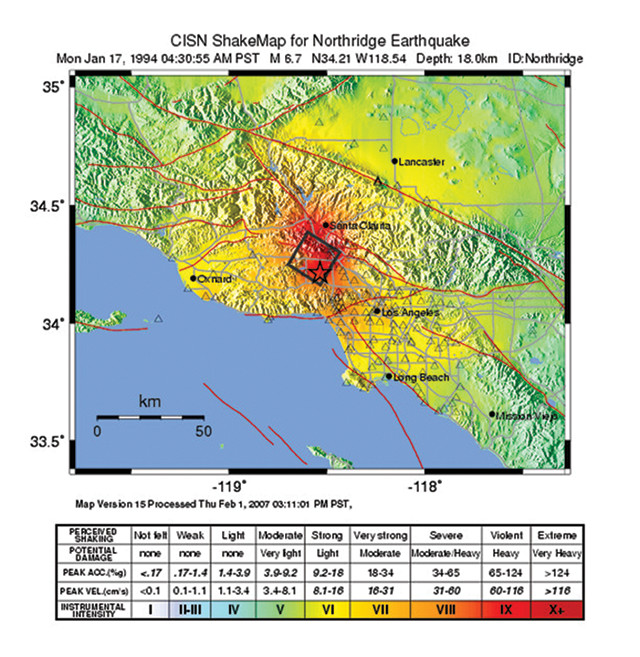

The new plan, available from Jumpstart Insurance Solutions Inc., a venture launched in October, relies on U.S. Geological Survey (USGS) data and tools to calculate premiums and payouts. It offers what’s called parametric insurance, which differs from traditional indemnity insurance in that it offers a set payout in the event that a predetermined parameter, or threshold condition, is met. Specifically, Jumpstart provides customers with a flat $10,000 payout — underwritten by Lloyd’s of London — if ground shaking near their property exceeds a peak ground velocity of 30 centimeters per second, as determined by the USGS ShakeMaps tool. On the Modified Mercalli Intensity scale, such peak ground velocities are associated with a shaking intensity of 7 or higher.

“We wanted to design a fast and simple system that helps people rebound after an earthquake,” says Jumpstart founder and CEO Kate Stillwell, a structural engineer and former earthquake risk consultant based in Oakland, Calif. “This fixed amount of money isn’t designed to make somebody whole, but it’s enough to give them a jump start.”

Both homeowners and renters in California can apply for Jumpstart earthquake insurance. Premiums, which average between $12 and $22 per month, are calculated based on earthquake occurrence probabilities by zip code according to the USGS National Seismic Hazard Maps. If an earthquake strikes and shaking exceeds the 30-centimeter-per-second threshold, Jumpstart sends a text message to each customer in the impacted region. And if a customer confirms that they suffered earthquake-related expenses, the $10,000 payment is directly deposited into the customer’s bank account. There is no deductible, and insured parties, who are not required to provide proof or details of their loss, can use the money for anything from replacing damaged property to paying for a hotel room to paying off the deductible on a traditional insurance policy.

Since payments are triggered by a predetermined threshold and not individual claims, it is possible that some people whose property incurred minimal or no damage will receive a payout, says Sam Gibson, a risk management specialist at RMS, a risk modeling company based in Hoboken, N.J. For insurers, he says, “this is one of the risks associated with parametric insurance plans.”

Jumpstart is the first company to offer parametric earthquake insurance but it’s part of a trend aimed at providing quick coverage in the wake of natural disasters, Gibson says. “This trend is riding on the ability of trusted independent third parties like the USGS and NOAA to provide accurate data in the immediate aftermath of natural disasters.”

Jumpstart capitalizes on the familiarity that many Californians have with ShakeMaps. “Californians are used to seeing these color-coded maps of shaking intensity,” Stillwell says. “The peak velocity threshold we chose roughly corresponds to the transition between yellow and red on ShakeMaps, so if you fall in the red zone, you’ll get paid.”

Using peak ground velocity instead of magnitude makes good sense, says David Wald, a USGS seismologist based in Golden, Colo., who helps run ShakeMaps for the USGS Earthquake Hazards Program. “It’s important for these products to be understandable and transparent,” he says. “Earthquake magnitude is completely undigestible for most people, but intensity is a lot more intuitive.”

California, as a whole, has a 99 percent chance of experiencing a quake of magnitude 6.7 or higher in the next 30 years, according to USGS estimates. Those chances vary significantly depending where in the state one is located, but only about 10 percent of homes across the state are protected by earthquake insurance. “Something is not working in California,” Wald says. “You can debate the ethics and economics of insurance, but the reality is that it’s an important key in fostering community resiliency after a disaster.”

Traditional indemnity-based earthquake insurance got a shakeup after the 1994 magnitude-6.7 Northridge earthquake that struck the San Fernando Valley region of Los Angeles. The peak ground velocity of 183 centimeters per second — the highest value recorded to date in the U.S. — caused as much as $50 billion in property damage, according to the California Governor’s Office of Emergency Services. At the time, between 25 and 30 percent of homeowners had earthquake insurance, and the $10 billion in insurance payouts far exceeded the premiums collected in the preceding 80 years.

A ShakeMap showing the intensity of ground shaking experienced in the Los Angeles area during the Northridge earthquake. Shaking that exceeds a peak ground velocity of 30 centimeters per second can trigger payouts to policy holders of a new parametric earthquake insurance offered by Jumpstart Insurance Solutions Inc. Credit: U.S. Geological Survey.

“After Northridge, a lot of homeowner’s insurance agencies stopped offering earthquake coverage because the risk was so high,” Stillwell says. In response to the resulting “crisis of unavailability,” the state created the California Earthquake Authority (CEA), which assumes the risk of insuring against hard-to-predict earthquake damages. The CEA operates as a not-for-profit agency that’s publicly managed but privately funded by participating insurers and through policy premiums.

“If you go to your [insurance] agent for a homeowner’s policy, you have the option to add earthquake insurance. In many cases, that earthquake insurance is actually a CEA policy, and we bear the risk for it,” says Glenn Pomeroy, CEO of CEA, based in Sacramento. “We match dollar for dollar the amount that the homeowner’s policy sets as the replacement cost of the home.” Because of the large uncertainties involved, earthquake policies typically have high deductibles. Currently, the CEA offers deductibles representing 5, 10, 15, 20 or 25 percent of the maximum value of the policy. Higher deductibles keep monthly costs lower, but in the event of an earthquake, the damage to the home must exceed that higher deductible for a policyholder to receive a payout. “This is the traditional indemnity approach to insuring a home: You have to have a loss, and be able to prove that loss, to receive a payout,” Pomeroy says.

Neither Stillwell nor Pomeroy see Jumpstart and CEA as competitors because the two programs fill different financial niches. “Traditional insurance is designed to make you whole after a devastating event, whereas [Jumpstart] is designed to put some cash in your hand immediately, whether you have a loss or not,” Pomeroy says. “The two options could actually complement one another very well. If you buy a parametric policy on top of traditional coverage, you could use the quick payout to hold you over until the full coverage comes through.”

If the fast payout by Jumpstart is its main selling point, the relatively small amount paid is the primary drawback, Pomeroy says. “When considering buying parametric coverage, a person needs to ask themselves how much they’re willing to pay for a limited amount of money,” he says. “If you’re a renter in California, for $240 a year you can buy a renter’s [indemnity] policy that offers a lot more coverage — up to $100,000 for your possessions and $200,000 in loss-of-use coverage if your apartment is damaged and you have to live elsewhere.” But, Stillwell says, Jumpstart may prove practical for the vast majority of homeowners who decline traditional earthquake insurance.

In California, there are just too many homes in vulnerable regions without earthquake insurance, Gibson says. “It’s much more efficient to think about how to close the gaps [in the earthquake insurance market] now, rather than waiting until after a major event to show us how big the gaps really are,” he says. “Offering people a way to get a quick payout right when they need it and keep their lives on track may go a long way toward improving community resiliency in the event of a major earthquake.”

© 2008-2021. All rights reserved. Any copying, redistribution or retransmission of any of the contents of this service without the expressed written permission of the American Geosciences Institute is expressly prohibited. Click here for all copyright requests.