by Michael E. Webber Wednesday, November 7, 2012

Liquefied natural gas (LNG), shown here aboard the British Merchant LNG carrier, is growing in popularity. When gas prices were high and domestic supply low a few years ago, companies built LNG terminals in the U.S. to import the fuel. Now that prices are lower and domestic supply is higher, some LNG terminal operators are modifying their terminals for export, so that they can buy cheap natural gas in the U.S. and sell it at higher prices in the EU and Japan. ©BP p.l.c.

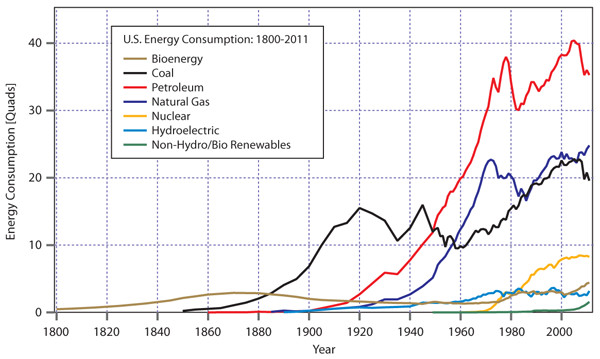

The U.S. energy consumption trends from 1800 to the present reveal that we have experienced several energy transitions. Although petroleum is dominant today, natural gas might be the dominant fuel within one to two decades. Michael E. Webber, data from EIA

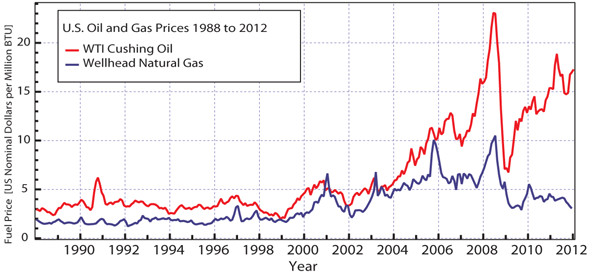

Natural gas and petroleum prices have roughly tracked each other in the U.S. for decades, but price trends started to diverge in 2009. Today, petroleum costs between $16 and $20 per million British Thermal Units (MMBTU), and natural gas costs less than $3 per MMBTU. Michael E. Webber, data from EIA

The U.S. has an abundant supply of natural gas, thanks in part to technological developments that have allowed energy companies to extract natural gas from unconventional sources such as the Marcellus Formation. Chesapeake, courtesy of Statoil

Despite the perception that wind and natural gas are competitors, the truth is that wind and gas benefit one another because they mitigate each other's biggest challenges. The price stability of wind solves the volatility of natural gas. The performance reliability of natural gas solves the variability of wind. ©BP p.l.c.

U.S. biofuels mandates — that gasoline must come from a combination of petroleum and fuel from sources such as switchgrass and other energy grasses, like these grown by BP in Florida — essentially dictate a 0.9 percent annual decline in petroleum use between now and 2022. ©BP p.l.c.

In the last year or more, you’ve probably heard quite a bit about “fracking” — hydraulic fracturing associated with oil and natural gas production from shale formations. Whether you think it’s a great new technology, or it’s going to ruin the environment, or your opinion falls somewhere in between, the reality is that it and other technological developments have likely forever changed the energy landscape. Thanks to these new developments, we now can affordably produce natural gas from rock formations that previously were inaccessible. And thanks to these developments, we now have more natural gas than ever before. The glut has decreased prices for at least a little while. If recent trends continue — namely if those prices stay low and various political, environmental and economic pressures to transition to a cleaner, domestic source of energy remain in place, it’s likely that over the next decade or two, natural gas will overtake petroleum to become the most popular primary energy source in the U.S.

For a century, natural gas has played an important role in our energy economy. Natural gas has long been valuable for cooking and heating. Over the last few decades, it has also started to play a key role in power generation. But, until recently, it played third fiddle behind coal and nuclear power. Now, that’s changing. A few years ago, the amount of electricity generated each month from natural gas surpassed that from nuclear power, and in April 2012, it surpassed coal for the first time in history. Coal’s contribution to electricity generation has dropped from 53 percent in 2003 to about 46 percent in 2011. At the same time, there was a slight drop in overall electricity generation due to the economic recession, so the rise of natural gas came at the expense of, rather than in addition to, coal.

At the same time, oil and petroleum products such as gasoline, diesel and jet fuel practically monopolize the transportation sector, providing about 95 percent of all its energy. Now, natural gas is also eating into that sector, too, albeit at a slower pace. A growing number of cities are starting to use bus fleets and trucks that are powered by liquefied natural gas (LNG), and even some passenger cars can operate on it.

The growing consumption of natural gas is driven by a number of factors. First, natural gas is considered more environmentally friendly than other energy sources. It has lower emissions of pollutants and greenhouse gases per unit of energy than coal and petroleum and it’s less water-intensive to produce than coal, petroleum, nuclear energy and biofuels.

Second, it has flexible uses across many sectors, as seen in the number of other energy sources it can displace. And third, the U.S. has a lot of it. Domestic production is supplying almost all of the annual U.S. demand, and in fact, we have enough of it that if the infrastructure were already built, we could export it. This prospect of making money from natural gas exports is an appealing thought to American energy consumers who send hundreds of billions of dollars overseas every year for petroleum imports. Finally, these days, the price of natural gas makes it very attractive to all sorts of end users.

In contrast, the trends for petroleum and coal are moving the other way. Petroleum use is expected to drop further because of price pressures and policy mandates, such as biofuels production targets and fuel economy standards. Domestic coal use is also likely to drop further because of growing demand from the developing world that will keep prices higher and because of tightening emissions standards expected to rein in emissions of coal-borne heavy metals, sulfur oxides, nitrogen oxides, particulate matter and carbon dioxide.

The biofuels mandates essentially dictate a 0.9 percent annual decline in petroleum use between now and 2022. And ongoing trends imply 0.9 percent annual growth in natural gas consumption for the industrial and power sectors. At those rates, natural gas would surpass petroleum around 2030. If the rates were to double, with a 1.8 percent annual decline in petroleum matched by a 1.8 percent annual increase in natural gas consumption, then natural gas would surpass petroleum in less than a decade.

An annual decline in petroleum of 1.8 percent is plausible through a combination of biofuels mandates (0.9 percent contribution), higher fuel economy standards (0.15 percent contribution), and price competition causing a switch from petroleum to natural gas in the transportation (heavy-duty, primarily) and industrial sectors (which could easily contribute another 0.75 percent to the annual decline). On the other hand, a 1.8 percent annual growth rate in natural gas consumption could be achieved if natural gas were to displace 25 percent of diesel use (for power generation, heating and transportation) and if natural gas combined-cycle power plants were to displace 25 percent of the 1970s- and 1980s-vintage coal-fired power plants by 2022.

This scenario is bullish for natural gas, but not implausible, especially for the power sector, in which power plants face stricter air quality standards and therefore might be put up for early retirement. Coupling all of these projections with a reduction in per capita energy use of 10 percent (less than 1 percent annually) by 2022 along with continued population growth implies that total national energy use would stay the same — a phenomenon that has been true for a decade.

These positive trends for natural gas do not mean that its use is problem-free. Environmental challenges persist. For example, land surface disturbances from production activity, possible water contamination issues, and induced seismicity from wastewater reinjection are concerns. Emissions from heavy equipment, gas leaks onsite, gas leaks through the distribution system, and flaring at production sites are also issues. However, if those environmental risks are managed properly, then these positive trends are entirely possible, and natural gas will take the reign from petroleum as America’s most popular fuel the same way oil and coal once took over from wood and whale oil.

But then there’s the issue of price. The price of natural gas has been relatively affordable and stable in the last few years, but if you look at the longer-term trends, you see that the price has traditionally been very volatile. In the following article, we’ll examine in greater depth the complicated pricing relationship that natural gas has with other fuels and market factors.

Given its complex relationships, can natural gas really be the fuel of the near future?

Natural gas has a lot of things going for it, perhaps most especially its current price and availability in the U.S. Although the price of natural gas currently is quite low in comparison to other fuel sources, it hasn’t always been low and there’s no guarantee it will stay low. There are several ways to think about natural gas prices — each of which will likely play an important role in driving the future of natural gas in the U.S. and globally.

One of the most important recent trends has been the decoupling of natural gas and crude oil prices. For decades, the two have roughly tracked each other in the United States: When petroleum prices were up, so were natural gas prices; likewise when oil prices were down, so were natural gas prices. But the price trends started to diverge slightly in 2006, and by 2009 they were headed in distinctly different directions. Today, very generally speaking, crude oil costs between $16 and $20 per million British Thermal Units (MMBTU), whereas natural gas — at $3 per MMBTU as of September 2012 — is significantly cheaper on an energetic basis.

This unprecedented price spread, if sustained, would open up new market opportunities for gas to compete with oil through fuel-switching. The price spread might inspire institutions with large fleets of diesel trucks (such as municipalities that own garbage trucks and long-haul trucking companies) to invest in trucks that operate on natural gas instead of diesel to save on fuel costs. Large industrial facilities might use gas instead of oil for heating. Or energy companies might consider investing in multibillion-dollar gas-to-liquids facilities to convert the relatively inexpensive gas into valuable liquids.

Another important trend has been the decoupling of U.S. and global natural gas prices. Leading up to 2009, U.S. prices were tightly coupled to those of global markets, especially those in the European Union and Japan, largely because we imported some natural gas from the global markets by ships that brought the fuel in liquefied form (known as liquefied natural gas, or LNG). In fact, U.S. natural gas prices between 2003 and 2005 were higher than in the EU and Japan because of declining domestic production and limited import capacity. In response, several private companies invested billions of dollars to increase LNG import capacity in the U.S. In a case of terribly ironic timing, the new import capacity came online right when domestic production began ramping up. Because domestic production grew so quickly, the imported LNG was no longer necessary, and much of the newly installed importing capacity remains idle and empty today.

So, the U.S. quickly went from being limited by its capacity to import gas prior to 2009 to being limited by its capacity to export LNG today. Concurrently with the switch, U.S. and global price trends started to diverge in 2009. How long the prices will remain decoupled depends on U.S. production of and demand for natural gas, as well as the time it takes for the isolated markets to reconnect.

In addition, a handful of LNG terminal operators are now investing billions of dollars to turn their terminals around so that they can buy cheap natural gas in the U.S. and sell it at higher prices to the EU and Japan. If all goes according to schedule, these terminals will be ready to start exporting gas beginning in 2014. Once they are able to export gas to EU and Japanese markets, then domestic gas producers will have additional markets for their product. If those external markets maintain their much higher prices, re-coupling will push our prices upward; that’s good for domestic gas producers, but expensive for domestic gas consumers.

The price at which we have an abundant supply of gas and the price at which we have abundant demand have changed over the years, as technology has improved and prices of competing fuels have shifted. But it seems clear that there is still a difference between the prices that consumers wish to pay and producers wish to collect. Above a certain price — say, $4 to $8 per MMBTU, although there is no single threshold that everyone agrees upon — the U.S. would be awash in natural gas because higher prices make it possible to economically produce many marginal plays, yielding dramatic increases in total production. However, at higher prices, the demand for gas is lower because alternatives (coal, wind, nuclear and petroleum) might be more attractive options.

On the other hand, as recent history has demonstrated, when prices are low — between $1 and $3 per MMBTU, perhaps — there is significant demand for natural gas in the power sector as an alternative to coal and the industrial sector because revitalized chemical manufacturing operations depend heavily on natural gas as a feedstock. Further, if prices remain low, then demand for natural gas would also increase in the residential and commercial sectors — as an alternative to electricity for space and water heating, for example — and eventually in the transportation sector in order to take advantage of the favorable price compared to diesel.

Although those low prices drive up demand, they discourage production of new supplies. As gas industry insiders say, “there is no cure for low prices like low prices.”

Whether high natural gas prices or low natural gas prices are better for achieving environmental goals, such as reducing the energy sector’s emissions and water use, also affects the demand for and price of natural gas. In many ways, high natural gas prices have significant environmental advantages because they induce conservation and enable renewables like wind and solar to penetrate into the energy market. However, inexpensive natural gas also achieves important environmental outcomes by displacing coal in the power sector.

In contrast to natural gas prices, which have decreased for several years in a row, prevailing coal prices have increased steadily for more than a decade due to higher transportation costs (which are coupled to diesel prices that have increased over that span), depletion of mines, and increased global demand. As coal prices climb higher and natural gas prices fall, the latter has become a more cost-effective fuel for power generation for many utility companies.

The environmental gains from cheap gas are offset to some extent, however, by the negative impacts associated with the significant amount of flaring that is occurring at production sites. Because natural gas is so inexpensive, it is difficult to justify rapid construction of costly distribution systems necessary to move the glut of fuel to markets. Hence, many operators end up being just flaring excess gas rather than distributing it.

One of the historical criticisms of natural gas has been the relative volatility of its prices, especially compared with coal and nuclear fuels. This volatility is a consequence of large seasonal swings in gas consumption along with the association of gas production with oil, which is also volatile. Thus, large swings in demand and supply can occur simultaneously, but in opposing directions.

Two forces are currently mitigating this volatility, however. First, the increased use of natural gas in the power sector — and not just for direct use in homes for heating — is helping to mitigate some of the seasonal swings as the consumption of gas for heating in the winter might be better matched with consumption in the summer for air conditioning load requirements. And second, because natural gas prices are decoupling from petroleum prices, one layer of volatility is reduced.

Many gas plays are now produced independently of oil production. Consequently, there is a possibility for long-term supply contracts at fixed prices. The combination of these two factors raises the prospects for improved price stability. At the same time, coal, which has historically enjoyed very stable prices, is starting to see higher volatility because its costs are coupled with the price of diesel for transportation. Thus, oil as a driver for price volatility is decreasing for natural gas and increasing for coal.

The relationship between the use of natural gas and renewables in the power sector is complicated. Renewables are seen as a threat to natural gas, and vice versa, because they compete to make money in the power sector.

Pro-natural gas interests complain about this rivalry, arguing that policies supporting wind give it an unfair advantage in the competition. Renewable energy supporters counter that gas interests are not required to pay for the pollution they produce — in effect, a form of indirect subsidy itself — and have enjoyed government largesse in one form or another for many decades.

Despite the perception that wind and natural gas are vicious competitors in a zero-sum game, where the success of one must come at the demise of the other, the relationship is actually more nuanced. In fact, wind and gas benefit one another because they mitigate each other’s biggest challenges, thus making each more valuable. The price stability of wind solves the volatility of natural gas. The performance reliability of natural gas solves the variability of wind.

Furthermore, many people seeking a long-term sustainable energy option will often reject natural gas automatically because it is considered a fossil fuel that has a finite resource base. Although most reserves of natural gas were formed many millions of years ago, it is important to note that natural gas can be produced through renewable means. Known as biogas or biomethane, this gas is mostly methane with a balance of carbon dioxide and is created from the anaerobic decomposition of organic matter. Although renewable natural gas is a small fraction of the overall gas supply, it is not negligible. For example, landfill gas is already an important contributor to many local fuel supplies. And recent studies have noted that the total potential supply available from wastewater treatment plants and anaerobic digestion of livestock waste is over 1 quadrillion BTU annually in the United States.

Overall, it is clear that natural gas has an important opportunity to claim a larger share of the energy market from other primary fuels, displacing coal in the power sector and petroleum in the transportation, industrial, commercial and residential sectors. With sustained growth in demand for natural gas and decreases in demand for coal and petroleum because of environmental and security concerns, natural gas could overtake petroleum as the most widely used fuel in the United States within the next few decades.

Along the way, price tensions manifested by a market containing a variety of fuel options, technological and societal forces will drive — and be driven by — the future of natural gas. These tensions will be exacerbated by the complicated relationship between natural gas and renewables. How and whether we sort out this complex array of tensions and relationships will have significant impacts on the U.S. economy and people.

© 2008-2021. All rights reserved. Any copying, redistribution or retransmission of any of the contents of this service without the expressed written permission of the American Geosciences Institute is expressly prohibited. Click here for all copyright requests.