by Carolyn Gramling Thursday, January 5, 2012

Vertical photobioreactors. Vertigro Images, per Valcent Products, Inc.

A scientist with the Department of Energy's Aquatic Species Program analyzes the oil content of microalgae in laboratory ponds. Warren Gretz, courtesy of National Renewable Energy Laboratory

A scientist at the National Renewable Energy Laboratory sudies how green algae can produce hydrogen directly from water and sunlight. Combined with water in a fuel cell, the hydrogen produces clean energy. Jack Dempsey, courtesy of National Renewable Energy Laboratory

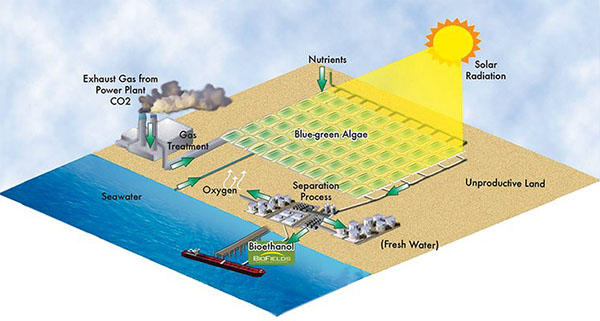

In September 2008, Algenol signed an $850 million deal with Mexico-based BioFields to grow algae in the Sonoran Desert. Algenol

Sapphire Energy unveiled its 'green crude' over the summer of 2008. Sapphire Energy

One way to grow a lot of algae: Go up. Valcent Products CEO Glen Kertz displays his company's vertical photobioreactors in El Paso, Texas. Vertigro Images, per Valcent Products, Inc.

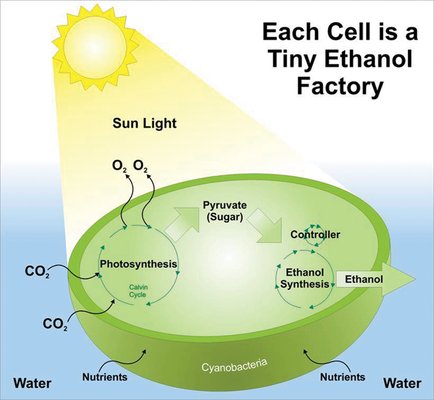

Instead of squeezing algae and collecting their oil, Algenol is trying to engineer the algae to produce ethanol directly. Algenol

It’s hard to think of a humbler organism than algae, or a less-likely prospect to become savior of our energy future. “Algae fuel” does not conjure up images of power, big business or high-tech gadgetry; it suggests a modest picture of a murky pond covered by a greasy, greenish film. But unassuming algae, some researchers think, have the potential to become the ultimate in “green” fuel, powering everything from cars to jets — and perhaps putting an end to one of the more bitter battles in the biofuels industry: the “food versus fuel” debate over how best to use arable lands.

Proponents of algae fuel technology say the commercial prospects of the field are much more ambitious and technologically complex than letting pond scum grow wild in the backyard. That misconception encapsulates one of the issues facing the field, says Stephen Mayfield, a cell biologist at the Scripps Research Institute in La Jolla, Calif.: Algae farming may capture the imagination of small-scale, environmentally minded entrepreneurs, but if it is going to be a viable substitute for oil and gas, it cannot remain in the backyard. Commercialization will require significant investment in molecular genetics research, algal physiology and engineering. And that takes money.

Algae already have a lot going for them: They can double in mass several times a day, produce more oil per hectare than other alternatives (such as Jatropha, rapeseed or palm), and unlike most other biofuels crops, algae can grow on coastal lands with salty or brackish groundwater. But the industry also faces significant technical challenges: growing the algae in a controlled way, harvesting it efficiently and integrating the fuel into existing petroleum infrastructure. And tumbling oil prices might make algae fuel considerably less appealing to investors. Nonetheless, entrepreneurs are still enthusiastic about algae: In 2008, about 50 companies entered the algae fuel business — up from about four in 2006.

“There are a lot of problems to be solved, but the really good news is that there are a lot of people interested in that and working on it,” says Billy Glover, managing director for environmental strategy at Boeing and co-chair of the Algal Biomass Organization, a one-year-old consortium formed by Boeing, DOE’s National Renewable Energy Laboratory, Scripps Institution of Oceanography, A2BE Carbon Capture Corporation, Benemann Associates, Montana State University and other institutions. “We have a great opportunity now,” Glover says, “as the world is turning its attention to clean energy.”

There are nearly 30,000 species of algae, ranging from the giant clumps of seaweed waving on the seafloor to microscopic freshwater and marine algae. It’s the microalgae — the ubiquitous single-celled organisms that sometimes form sticky mats and tend to be the starting point of many aquatic food chains — that are of interest to biofuels producers.

Mayfield, who has been studying algal molecular genetics for 25 years, says that it is only in the last decade that he has worked on algae’s energy potential. Algae’s natural ability to make lipids, which store oil, has been known for a long time, he says. But until recently, algae’s oil simply wasn’t the most interesting or lucrative thing about the green stuff. Instead, there was interest in how algae could be used in biotechnology: For example, in 2003, Mayfield’s lab announced a way to produce large proteins — such as antibodies that target the herpes virus — by inserting a gene into algae and letting the organisms assemble the proteins.

“There are a lot of things more valuable in algae than the fat we’re going to take out of them and burn. Lots of things can burn,” Mayfield says. Oil, coal, wood — historically, they all have been relatively plentiful and cheap. “So most of us [in the algae field] said we’re not going to spend time working out clever engineering to make something that can sell at 50 cents a pound, when we can make antibodies that sell at millions of dollars a pound.”

In the 1980s and 1990s, the federal government had its own research program devoted to turning algae into energy. Algae had a lot going for it as a potential source of biodiesel: When exposed to sunlight, algae rapidly reproduce and photosynthesize, converting carbon dioxide into sugar. The sugar is metabolized into lipids, or oil. The oil is then mixed with alcohol, such as ethanol, to produce biodiesel. Additionally, certain strains of algae naturally produce as much as 60 percent of their biomass as oil, while others are powerfully resistant to extreme heat, salinity or acidity. Algae growth easily outpaces land crops and requires no fertilizer (just water and sunlight). And green algae are plants, and therefore consumers of carbon dioxide.

So in 1978, the Department of Energy began the Aquatic Species Program, operated by the National Renewable Energy Laboratory, to study how to produce oil from algae grown in ponds (and nourished with carbon dioxide from coal-fired power plants). During the course of the program, the scientists explored algae metabolism and how to tinker with the cells' natural ability to produce oils, hoping to make the process more efficient.

The program was cut in 1996, but the Aquatic Species Program team produced a final report two years later that summed up what the researchers had learned about the advantages of algae as a source of biofuel. “Put quite simply, microalgae are remarkable and efficient biological factories,” the report stated, “capable of taking a waste (zero-energy) form of carbon (CO₂) and converting it into a high-density liquid form of energy (natural oil).”

Despite this promising start, the researchers concluded that “they didn’t see any future” for the technology, says Nigel Quinn, a civil engineer at the Lawrence Berkeley National Laboratory in Berkeley, Calif. Gas and oil prices were still too low.

But now, algae may be working its way back onto the federal government’s energy radar. Increases in the price of oil have helped drive that interest, and although last summer’s record-high oil prices dropped dramatically by fall, other factors have come into play, Quinn says. Those include advances in biotechnology, a rapidly growing interest in carbon-neutral technologies and anxiety over using arable land for fuel rather than food crops.

Quinn is part of a team of scientists at the Energy Biosciences Institute, a research collaboration between Lawrence Berkeley National Laboratory, BP and the University of Illinois, that is compiling a new study on the current state of algae technology. “What we’re trying to do is figure out where our niche might be,” Quinn says. “If we’re going to get into this, what sort of competitive advantage might we have?” Algae is just one topic of discussion at EBI, Quinn says — and not necessarily the primary one. Much of EBI’s research is in so-called “second-generation” biofuels, which use non-food crops, including cellulose from plants such as switchgrass and Miscanthus, to produce ethanol. Algae is considered the “third generation” of biofuels. And it’s the task of the “real believers” — who are convinced that this is an incredibly exciting area, Quinn says — to convince their more skeptical colleagues.

“The big problem right now is cost,” he says. The costs include buying the land, pumping water for the algae, harvesting the algae, and developing the technology to produce the oil, often done by pressing the algae like olives into a thick paste and extracting the oil. Other methods use compressed carbon dioxide to vaporize the lipids, extract them and then recondense them, or use solvents to remove the lipids.

Different algae companies are tackling these issues in different ways. Algae are generally grown in two ways: in large open-air “raceways,” water-filled ditches that are gently stirred to keep the algae happy; or in clear, closed tubes called photobioreactors. There are advantages to each method: Growing algae in the open air is far less expensive, but the algae are vulnerable to invasion by less desirable strains. In a closed reactor, on the other hand, it is possible to ensure that the algae strain you’ve got is the precise one you want, Quinn says. “For oil production, you can get a very consistent product that way.” However, the setup costs are considerably more expensive.

Although both systems have been successfully tested in the laboratory, ramping them up to commercial production is tricky. A cautionary tale comes from GreenFuel Technologies: In early 2007, six-year-old GreenFuel was at the vanguard of the algae fuel industry, having opened an ambitious new greenhouse of photobioreactors in Arizona as a prelude to making its fuel commercially. Time magazine named the founder of the company, Isaac Berzin, one of the world’s most influential people. But by July 2007, GreenFuel was already suffering setbacks. The greenhouse grew the algae too rapidly for the company to harvest, and the resulting overabundance of algae limited light and nutrient supplies and ultimately killed the algae. Meanwhile, GreenFuel faced spiraling costs for its algae-harvesting system. A year later, GreenFuel is making a comeback, but now has to contend with a larger field of competitors.

With much of the research still in the proof-of-principle phase, only a few big players have entered the algae business. Some of the more established companies (such as Solazyme, Solix and LiveFuels) have engaged in clever bioengineering and fuel processing techniques, producing their own twists on algae oil. But many of these companies have raised only $5 million to $10 million, and whether those small investments will be enough to help the companies stay afloat is not yet clear.

A few very well-funded companies are emerging as leaders of the pack. One such company is Sapphire Energy, based in San Diego, Calif. Sapphire has powerful friends: Partially founded by Mayfield and holding investments from Bill Gates, Arch Venture Partners and others, Sapphire has raised more than $100 million, a far cry from competitors working with funds of $5 million and $10 million. Sapphire uses the raceway cultivation technique, but says it has gotten around the invasive strain problem (as well as potential fears of runaway algal blooms) through genetic modification — growing algae that can only survive in a small ecosystem niche.

Over the summer, Sapphire unveiled its “green crude,” a type of algae-derived fuel (Sapphire says it is neither biodiesel nor ethanol because it is chemically identical to current gasoline) that is refined with existing refining processes, and can therefore be easily blended into the current infrastructure for oil and gas. The process is a carefully guarded secret that involves genetic engineering and agricultural breeding, and according to the company, has already produced gas, diesel and jet fuel that each meet fuel standards. Sapphire says the company is on course to produce 10,000 barrels of crude oil per day within five years from just one facility.

Another primary player is Algenol, a private company based in Boulder, Colo. Paul Woods, Algenol’s CEO, says his company has two major advantages over most of the competition: a unique harvesting technology and plenty of money.

Woods has been researching algae-as-biofuels since the 1980s, often in his spare time — first as a graduate student and later while running a successful natural gas company in the 1990s. After patenting a new harvesting process for algae that converts the algae’s sugars directly into ethanol (thus bypassing the production of oil), Woods and three other founders created Algenol, contributing more than $70 million of their own money to the company.

Every photosynthetic organism makes its own internal sugars, which are metabolized into lipids, Woods says. But, he adds, some — not all — algae can actually directly make ethanol in the dark through respiration. This generally occurs “in survival mode or when they’re stressed.” That direct-to-ethanol reaction only happens in small quantities, however, so Algenol has genetically modified the algae to make more ethanol under these conditions. (Algenol isn’t the only company to grow its algae in the dark: San Francisco-based Solazyme grows its algae in stainless steel vats and feeds them sugar instead of sunlight.)

Algenol’s other innovation is its harvesting method. Ethanol is highly evaporative, preferring to escape into the air. So instead of killing the algae by pressing them to extract their oil, Algenol leaves the algae in their glass photobioreactors, and instead just collects the ethanol that has already evaporated into the tubes. “Since we’re not harvesting them, we don’t touch them,” Woods says. “That’s the massive advantage of our process.” Algenol is now building a new facility to grow algae in Mexico’s Sonoran Desert, part of an $850 million deal the company signed in September with the Mexican company BioFields. Help from the Mexican government has been invaluable, Woods says. In the United States, “finding a chunk of land without government help has been difficult.”

Most algae biofuel companies give a timeline of about three to 10 years to commercial production. Algenol, for example, expects to produce 100 million gallons of ethanol by the end of 2009 at its Sonoran Desert facility, and to increase to 100 billion gallons by 2012.

After a decade-long hiatus, the federal government is getting back into the algae biofuels game. In October 2007, the National Renewable Energy Laboratory announced a partnership with Chevron to look for and develop strains of algae that can be processed into transportation fuels, such as jet fuel. The military is also interested, Quinn says: Growing algae oil near a military base in Hawaii instead of shipping fuel to Hawaii from the mainland could potentially offer huge savings.

In January 2008, Congress passed a budget bill that increased federal funding for biomass and hydrogen fuels research. Although the bill included no funds specifically for algae fuel research, Congress did urge the Department of Energy to “study the CO₂ accelerated growth algae technology to recycle carbon and produce fuels.”

Whether DOE plans to commit any funds to algae is still uncertain, but algae industry leaders are hopeful. In December 2008, scientists and algae business leaders met with DOE in Washington, D.C., to outline a roadmap of technology challenges and funding needs, says Mayfield, who participated in the meeting. “This is the intellectual exercise that has to be done if we are going to make logical, correct investments in this.”

Indeed, the industry has picked up a lot of steam over the last year or two. Last October, more than 700 people gathered in Seattle, Wash., for the second annual Algae Biomass Summit (more than double the number of attendees at the inaugural summit the year before). The 2008 crowd included not only algae scientists, engineers and longtime biofuels proponents, but also venture capitalists, military representatives and commercial aviation companies like Boeing and KLM. They were all drawn to what seemed in the early summer months to be a perfect storm of opportunity for a hot new renewable fuel: record-high oil prices, rapidly growing concerns over carbon dioxide emissions and global warming, and panicky speculation over whether the world has already passed the peak oil pinnacle.

Despite the growing enthusiasm, the October summit made it clear that the industry is not yet integrated, Glover says. “There isn’t an emergent leader in algae development. There are a variety of players, from basic cultivation and [algae] strain collection, to processing and post-processing technologies. But there isn’t really some group that is bringing that whole chain together in an integrated fashion.” That integration, he adds, is one of the things he expects to see emerge as the industry matures over the next few years.

“There’s a realization that the U.S. can establish itself as a world leader in this area,” Quinn says. “A lot of us in the universities have thought this for a long time.”

The Algae Biomass Summit came on the heels of high oil prices, but falling prices threaten to wreak havoc on the fledgling industry. The larger companies, however, expect to weather the price fluctuations. Sapphire Energy says its business model has always included being cost-competitive with oil companies — even when the cost of oil was $60 a barrel. “So the daily fluctuations in the price do not worry us,” the company says.

Algenol is also cushioned to some extent, because it isn’t looking for investors, Woods says. “We’re a private company. If we were out looking for money right now we would probably just shut our doors — it’s an impossible environment to [raise] money in.” He says he also worries that the low oil prices will take attention away from renewable energy. “I’m incredibly fearful that it will. We had a run-up of fuel prices in the 1970s and 1980s and a huge scream for renewables, and peoples' attention just died away” when the oil prices dropped. However, he says, one hopeful note is that the Obama administration has promised to focus on renewable energy.

The algae industry probably will take a hit from the dropping prices — particularly the smaller upstart companies, Mayfield says. Those who think it’s a simple matter of setting up ponds — who aren’t making the necessary investment in science and technology — are the people who’ll be shaken out if oil prices stay low and investors balk, he adds. “I’m just hoping that the pendulum doesn’t swing back and get rid of people who are willing to make the investment.”

But Mayfield feels confident that the overall industry will progress. Things are different now than in the 1970s, he says, and no one knows that better than Big Oil. Companies concerned with cutting down emissions — and especially dwindling worldwide supplies of oil — are doing the math and eagerly looking for alternatives.

“Every single major oil company has been by to visit me,” he says. “They do not make bets on social issues; it’s economics.”

© 2008-2021. All rights reserved. Any copying, redistribution or retransmission of any of the contents of this service without the expressed written permission of the American Geosciences Institute is expressly prohibited. Click here for all copyright requests.