by Carey W. King Tuesday, July 18, 2017

Traditional macroeconomic models are an unstable foundation for decision-making when planning for a low-carbon future. Credit: K. Cantner, AGI.

Since April 22, 2016, leaders of 195 nations have signed the Paris climate accord, which starts the process of voluntarily committing to greenhouse gas emissions limits for each country. The agreement was an important signal to the world that the presidents of the two largest economies and greenhouse gas emitters — President Barack Obama of the U.S. and President Xi Jinping of China — were willing to cooperate with the rest of the world on a truly global environmental matter. On June 1, 2017, President Trump stated that he is backing out of the agreement, fulfilling his campaign pledge, but the other signatories indicated they would continue to support the global, voluntary plan for dealing with climate change.

The primary goal of the Paris Agreement is to spur the enactment of measures that will limit greenhouse gas emissions enough to prevent the average global temperature from rising more than 2 degrees Celsius above preindustrial levels. The agreement includes financial plans and a framework for reporting and verifying emissions and mitigation efforts within each signatory country. Whatever your feelings are about the details of, and motivations behind, the agreement, there’s one thing you need to know: It will be nearly impossible to meet the 2-degrees-Celsius goal while continuing to grow the world economy as fast as historic rates. That’s because the outcomes of economic models used to inform policymakers and policies like the Paris Agreement are fundamentally flawed to the point of being completely delusional. It isn’t the specific economic assumptions related to the “low-carbon” transition that are the problem, but structural flaws in the economic models themselves.

There is a very real trade-off between the rate at which we address climate change and the amount of economic growth we can expect during the transition to a low-carbon economy, but most economic models insufficiently address this trade-off, and thus are incapable of assessing the transition. If we ignore this trade-off, or worse, we rely on models that are built on faulty premises, then we risk politicians and citizens revolting against the energy transition midway into it when the substantial growth and prosperity they’ve been told to expect will accompany the low-carbon transition don’t materialize. It is important to note that citizens are also told that doubling-down on fossil energy also only provides growth and prosperity. But this is a major point of this article: mainstream economic models can’t tell the difference. There are foreseeable feedbacks of a fast transition to a low-carbon economy that increase the risk of major recessions. If we want to maximize our ability to achieve our future energy, climate and economic goals, we must improve macroeconomic modeling concepts.

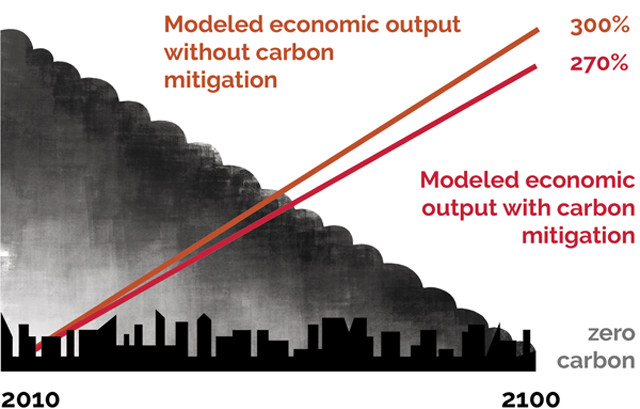

Some economic models project that the global economy will be 300 to 800 percent larger in 2100 than in 2010 if no steps toward greenhouse gas mitigation are taken. These same models estimate that with a protocol of full greenhouse gas mitigation, which would keep the world within reach of the 2-degree-Celsius warming target, growth would only see a 10 percent reduction relative to the no-mitigation case. Credit: K. Cantner, AGI.

To stay below a 2-degree-Celsius temperature increase by 2100, the world must reduce emissions of greenhouse gases like carbon dioxide and methane primarily by switching to low-carbon energy sources. That means using more renewable energy and less coal, oil and natural gas in everything from power generation to transportation fuels. The goal is to keep the greenhouse gas concentration in the atmosphere from surpassing 450 parts per million (ppm), while current levels of carbon dioxide, the most prevalent greenhouse gas, are at 410 ppm. It’s a noble ambition.

Climate scientists, engineers, policy advocates and economists are trying to work together to project climate and economic interactions that could occur during the transition to a low-carbon economy. They use what are called Integrated Assessment Models (IAMs) that link earth systems models to human activities via economic models. These IAMs have informed the Intergovernmental Panel on Climate Change (IPCC), and IPCC reports, in turn, inform policymakers.

The earth systems components of IAMs project changes to climate from increased atmospheric greenhouse gas concentrations, land-use changes, and other biophysical factors. The economic components of the IAMs characterize human responses to changes in the climate and in energy technologies needed to limit emissions. It is the economic element of the IAMs that is concerning.

For example, the IPCC’s Fifth Assessment Report (AR5) projects a range of “business-as-usual,” or baseline, scenarios — assuming no greenhouse gas mitigation strategies are pursued — in which the world economy is between 300 and 800 percent larger in the year 2100 as compared to 2010. The report then discusses how various levels of greenhouse gas mitigation might impact economic growth. The economic modeling assumes that additional financial investments in technologies and practices, beyond those tallied in the baseline scenarios, will be needed to reduce greenhouse gas emissions. These additional investments transition the world to low-carbon energy sources such as large-scale carbon capture and sequestration, wind turbines, solar panels, and other technologies and strategies. But they also cause higher energy prices in the models and, hence, the economy is predicted to grow less.

The AR5 indicates that if the world invests enough to reduce greenhouse gas emissions over time — such that total annual greenhouse gas emissions are practically zero by 2100 — to stay within the 450 ppm and 2-degree-Celsius target, then the modeled decline in the size of the economy relative to business-as-usual scenarios is typically less than 10 percent. In other words, instead of the economy in 2100 being 300 to 800 percent larger than in 2010 without any mitigation, it is only 270 to 720 percent larger with full mitigation. Meanwhile, there is no reported possibility of a smaller future economy. Apparently, we’ll be much richer in the future no matter if we mitigate greenhouse gas emissions or not.

This result is delusional and doesn’t pass the smell test.

The problem is that the economics behind most IAMs is based on a few flawed premises. One premise — an input assumption that the global economy will continue to grow strongly, and thus have all of the energy it needs at low cost — provides a faulty baseline. The modeling growth assumption is embedded in a factor for “technological progress” or “productivity.” This productivity is assumed to increase at near historical rates, independent of the rate and scale of changes in the energy system, such that energy costs do not significantly increase over the long term. It is not easy to eliminate this assumption entirely, but existing research shows that technological progress, as assumed in mainstream models, is largely described by the amount of energy we consume as final services (heating, cooling, transport, power and light). One concept that could improve economic modeling is not assuming historical rates of productivity.

Another flawed piece of the framework in the IAMs is that they assume that factors in the economy during and after a low-carbon transition will remain at or return to the statistically positive trends of the last several decades — the trend of growth, the trend of high employment levels, the trend of technological innovation. Those positive trends change over time, however, so it is faulty to assume they’ll continue at historic levels independent of the need for rapid changes in the energy system. They also assume that energy costs will not significantly increase over the long term. Further, they extrapolate trends in growth, employment and technology from the past and current carbon-based economy to apply to a future decarbonized economy in ways that represent guesswork at best, and ideology at worst. Our current global economy continues to reside outside the realm of historic norms: For example, our low central bank interest rates, low economic and population growth, and high debt are out of line with statistical averages. And these indicators will stray even further from historical norms when we decarbonize. This is not to say we shouldn’t pursue a low-carbon transition, but we need to be aware of the realities that will confront us through such a transition.

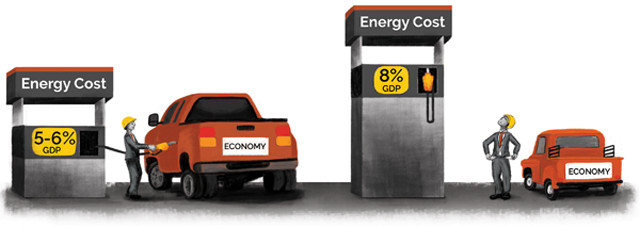

There is a substantial negative feedback between high energy costs and overall economic output. Credit: K. Cantner, AGI.

Perhaps most importantly, IAMs do not consider the substantial negative feedback between high energy costs and overall economic growth. Negative feedback means that when one factor increases (energy prices, for example), another factor consequently decreases. Many of us know from practical experience that if gasoline costs too much — like when it was near $4 per gallon in 2008 — it may eat into our budget to such an extent that we can’t pay all our bills or can’t pursue hobbies. On a personal level, then, we see that increased gas prices cause decreased discretionary spending — a negative feedback. This idea can be extended to the entire economy’s budget and income.

The U.S. economy has historically seen spending on energy equivalent to 5 to 6 percent of gross domestic product. However, in the 1970s and in 2008 — during two energy/economic crises — the U.S. and developed economies’ energy spending rose to approximately 8 percent. Both of these periods were characterized by deep recession, raising questions about how the economy works, and instigating subsequent changes in economic outlooks. The global and U.S. economies operated fundamentally differently after the 1970s than before. Before the 1970s, the concept of energy efficiency did not exist. Likewise, the global and U.S. economies are operating fundamentally differently post-2008. The new concept, in wealthy countries at least, appears so far to be one of stagnant to declining energy consumption.

Yet, IAMs have economic assumptions that don’t anticipate the possibility of a linkage between energy spending and recession. This lack of a temporal link between energy and growth is a significant flaw related to the lack of realistic consideration of debt and time. It is imperative that we model the low-carbon transition using frameworks that consider the feedbacks of the cost of energy, including its impacts on food production and costs, as a function of timing and the related debt. If we don’t do this, then the macroeconomic models can’t anticipate real macroeconomic events, including recessions induced from changes in the energy sector and debt accumulation.

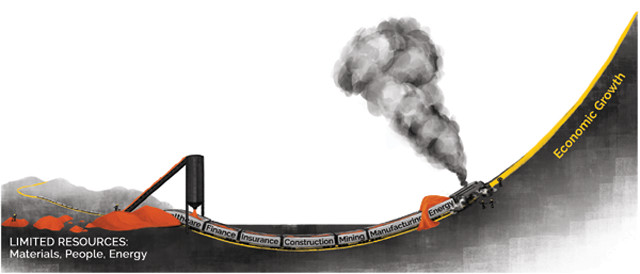

Economies operate quite differently after a deep recession. Macroeconomic models often assume historical trends will continue even though that's not a safe assumption. Credit: K. Cantner, AGI.

We know that high energy costs played a significant role in past recessions in the 1970s and the Great Recession from 2007 to 2009. This raises the question of whether a transition to a low-carbon economy will raise energy costs to such an extent as to cause a recession. I believe this is a very real possibility, and it is more likely than not to occur if we make energy system investments at rates required to limit atmospheric greenhouse gas concentrations to 450 ppm and keep average global temperatures from rising more than 2 degrees Celsius. This is why we need to accept the possibility of lower growth, or even contraction, during a transition to a low-carbon economy.

Ideally, we need methods to help us understand if, and to what extent, the Great Recession and debt accumulation were linked to rises in energy and food costs. We can look at the oil shale boom-bust for instruction.

During the Great Recession, economic output declined as consumers acquired so much debt they were forced to reduce their demand. Subsequently, the price of practically all commodities, including oil (the price of which had peaked in mid-2008), dropped precipitously. Starting in 2009, however, oil prices started rising again, largely driven by accommodating fiscal policies (such as quantitative easing by the Federal Reserve) and the U.S. government purchasing debt from private banks. As oil prices rebounded, natural gas prices stayed low. Thus, the oil and gas industry shifted its focus with hydraulic fracturing from producing natural gas to producing oil.

The boom was on. From the summer of 2009 to 2012, the number of rigs drilling for oil in the U.S. rose from 200 to more than 1,400, remaining at more than 1,300 through 2014 before subsequently dropping quickly to below 400 by March 2016. The fundamental reason for the drop was that the energy sector grew too large relative to the rest of the economy.

uring the boom, oil and gas companies were paying near-six-figure salaries to high school graduates for driving trucks full of oil, water or sand. These salaries were supported by the high price of oil, between $80 and $120 per barrel from 2011 to fall 2014. But the developed economies are simply not currently configured to both grow quickly and pay more than $80 per barrel for extended periods. And, worldwide, expenditures on energy were higher than 7 percent relative to gross world product during the post-recession boom, indicating relatively high energy costs historically. If paying more than $80 per barrel, and thus 7 percent or more of gross world product on energy, were a growth-compatible condition, the oil price could have stayed high for longer. But it didn’t. There were simply too many resources and people allocated to produce energy.

If resources are overallocated to the energy sector of the economy, other sectors will have fewer resources to support them. This overloaded energy sector puts strain on the economic engine, slowing or stalling economic growth. Credit: K. Cantner, AGI.

By early 2016, oil prices had fallen to about $30 a barrel; today they’re in the $40 to $50 range. The salaries of oil consumers were not high enough to pay — at the pump — for the increasing salaries of the oil producers. Additionally, many oil companies involved in shales were continually spending more money than they were making, and many have since gone bankrupt. Trends in the U.S. oil industry now point to mechanization to reduce labor needs.

So how is the recent oil shale boom-bust cycle a relevant analogue for a low-carbon transition? The oil shale boom of 2011 to 2014 increased the amount of economic activity in the energy sector, which thus imposed higher costs on the rest of the economy. To stay below a 2-degree-Celsius temperature increase, the required rate of investment in the energy sector can again trigger resource allocations that are outsized with respect to what the rest of the economy can handle.

The faster we move toward a low-carbon energy future, the larger the allocations of materials, energy and people to this effort will be. And the larger these allocations, the higher the cost of energy. As we’ve seen in the past, if the cost of energy increases rapidly and/or becomes too high, the economy can go into recession. And energy costs during a low-carbon investment boom are likely to be much higher than in the shale oil boom, so a resulting recession could be even more substantial. Most low-carbon scenarios and models assume combinations of declining carbon dioxide emissions and increasing economic growth that appear incompatible even when compared to the most favorable of times historically.

So, how do we rectify the economic models to predict what we really need to know? First, the models currently answer a question that is barely useful: “If the economy grows this much, what types of energy investments can we make, and at what rate?” The models should address the question we really need to answer: “If we make these energy investments at this rate, what happens to the economy?”

To answer this question, we need models with at least a few basic characteristics. First, they need to capture dynamic processes and feedbacks in the economy that act on timescales longer than weeks but shorter than decades. This medium timescale is long enough to avoid details of short market fluctuations, but short enough to be relevant for investment decisions, company solvency and recession.

Second, they must include debt dynamics during the low-carbon transition — an important aspect missing from existing models tracking material and energy resources. In other words, we need to know who acquires debt (such as electric utilities or private developers) and who owns debt (for example, pension funds, private banks, governments, citizens or consumers) related to low-carbon energy investments. Thus, we can track which set of investors are dependent on the ability of a set of consumers to pay for that low-carbon energy. This is so that we can assess how many people are expecting income from low-carbon energy investments.

Third, the models need to track employment and wages. (Of the three characteristics just mentioned, this is perhaps the one most often included in existing models.) This is related to the ability to track the debt. It doesn’t matter if low-carbon energy has low costs if employment and wages decline faster (as might happen due to continued automation) than those costs such that consumers become less able to afford energy, low or high carbon.

By incorporating these three characteristics in a consistent single model, we can assess if a low-carbon transition is likely to be feasible in the future we hope to see — that is, one with low debt, high employment and/or high wages — or a less desirable future we might have to accept, with high debt, low employment and/or low wages.

If we do fix the models, what can we learn about the real prospects of transitioning to a low-carbon world and what scenarios could we more accurately test? We could probe, for example, the feasibility of investing in low-carbon infrastructure only as fast as we can without shrinking the economy. This scenario could offer a viable trade-off between pursuing our communal goal of reducing greenhouse gas emissions and facing the realities of economic limitations in that, during any given period, we invest in the low-carbon transition only to the extent that we don’t intentionally make ourselves poorer. If the economy moved toward, or into, a significant recession — which could occur independent of a low-carbon transition — we could temporarily stop or slow low-carbon investment. If economic output did decline, greenhouse gas emissions would also likely decline, although they would do so due to decreases in energy consumption rather than increases in consumption of low-carbon energy. (The former situation most closely describes why the European Union (EU) has been meeting its greenhouse reduction targets during the last several years. The EU has largely met its carbon-reduction targets because the economies of the major EU countries are smaller than was projected when they set their emissions targets. Of course, the original assumption in setting those targets was that both energy consumption and economic output would continue to increase alongside decreasing emissions.)

Credit: K. Cantner, AGI.

There is a fundamental conflict between achieving low- or zero-carbon energy systems and growing an economy. Both the scale and rate of change during a low-carbon transition matter. So, let’s create macroeconomic models that can plausibly replicate historical trends of the most important energy and economic variables in times of high energy investment, recession and growth, so that we have confidence that we can ask relevant and informative questions about how low-carbon investments impact economic growth. Let’s stop deluding ourselves by using models that assume answers we want to see.

© 2008-2021. All rights reserved. Any copying, redistribution or retransmission of any of the contents of this service without the expressed written permission of the American Geosciences Institute is expressly prohibited. Click here for all copyright requests.